In four trading days, the sentiment has gone from “the correction is finally here, the world is totally unstable”, to “the Fed can’t raise rates because the consumer is in trouble”. Is one of those supposed to be good news? Here is the truth: Retail sales rose 3.7% over last July. (month on month results are great headlines but miss the point) The economy is doing fine and nothing has changed. Meanwhile, historical patterns and typical 3rd week OPEX cycle volatility occurred, almost as if it was by script.

The VIX September future dropped by 6% to levels seen before the sell-off:

As the VIX fell to 13:

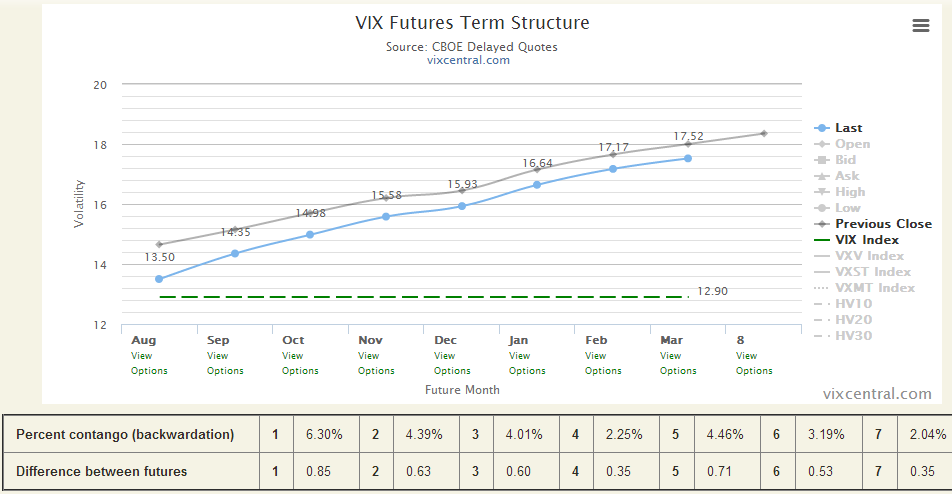

The VIX futures curve steepened, and contango magically reappeared:

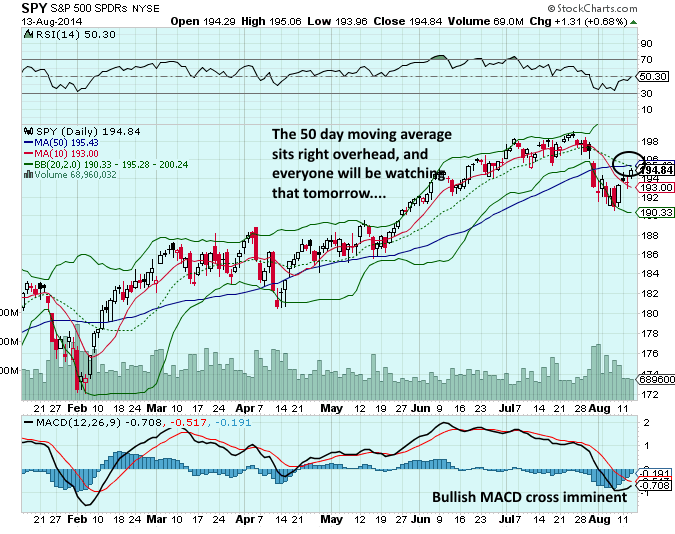

The SPY has retraced 50% of the drop, making Fibonacci fans excited:

So for the bulls, it appears to be all systems go for now. Our short positions on long vol have evaporated in a couple of days, and it is time to start looking at the other side of the coin. I started nibbling at selling premium on short volatility today, knowing that these bull moves can play out for a while. If nothing more, I’m establishing some hedges.

The middle of August into OPEX and just beyond historically sets up bullish, so lets see if this year continues to play by the book.

This week’s newsletter was published last night and the link to subscribe is above.