Trends are the name of the game to algos and a lot of traders, and today’s action was almost methodical in adhering to the short-term bearish trend that has been in place for nearly two weeks. August is living up to its reputation as the worst month for the indices since 1987, and every small bounce is being sold. If you are a short-term trader, buying the VXX dips is working wonderfully.

I’m not that type of trader, I like to think of shorting mispriced options as more of an investment. Wait patiently for good prices, then be a little contrarian in behavior with a longer-term view. We are getting some nice prices now, if you can handle the how these options fluctuate in value in the short term. But realistically, the calls I’ve been selling have almost zero chance of being worth anything come expiration. There is no financial crisis looming like there was six year ago, central banks are far to accomodative, corporate earnings are too good, and economic data for the most part is just fine. What we are seeing in the markets is quite normal behavior.

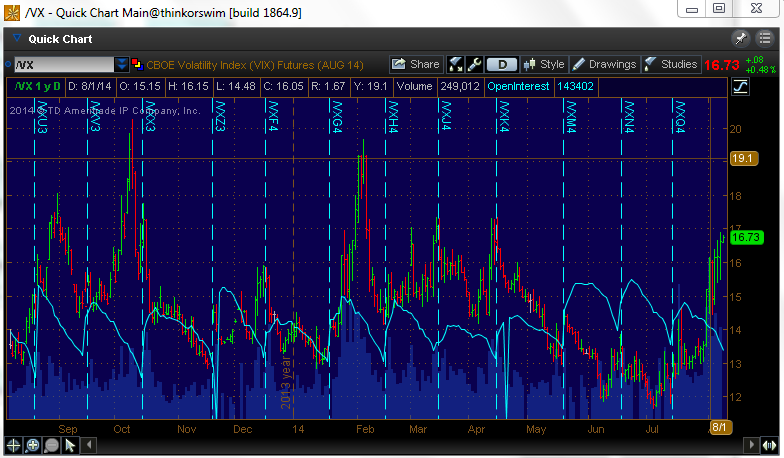

As the selling resumed today, the front month future reached a high point going all the way back to tax day 2014:

While the VIX itself was rejected at last Thursday’s level:

Being that this is the week before options expiration, its not surprising that volatility is high, or at least high relative to recent times. A peek at the VIX wave for this OPEX cycle shows that it tends to fade in August after this week. Tomorrow is day 15:

The S&P 500 found a little support at the 100 day moving average. And as you can see from prior trips to the 100 this year, a few closes below it didn’t really mean much:

The IWM is still showing more of a basing pattern than the Dow or S&P:

And the highly watched Dow transports spent most of the day in positive territory as it nears the 100 day moving average. The selling here is getting old as well:

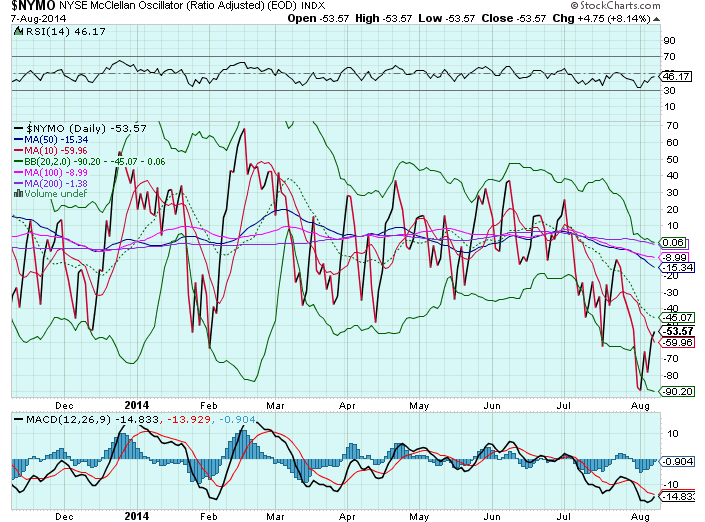

And breadth is starting to turn internally. Look at the NYMO:

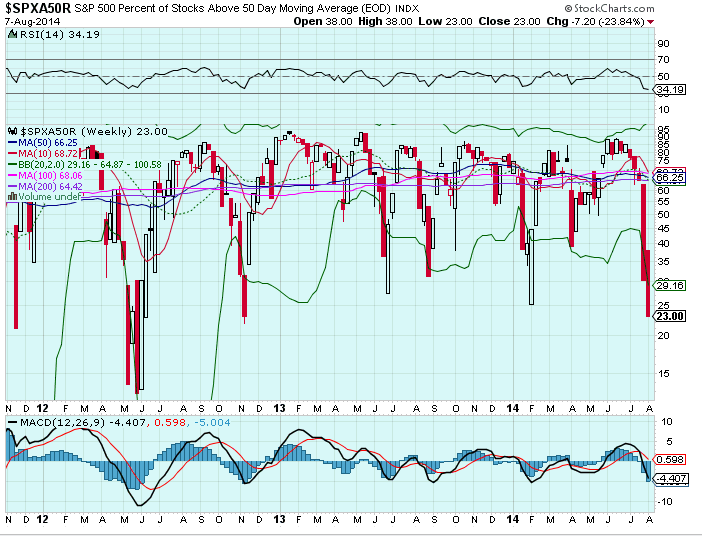

And the stocks trading below their 50 day moving average has reached back to 2012 levels:

The bottom line is that we could have a washout and higher volatility, but we are due for a bounce.