This is what August looked like last year. Let me refresh your memory as there was nothing to remember. (Is that a non-sequitur?) I only recall it because it was amazingly placid:

The majority of August saw the S&P in a 20 point range. We started this trend early this year, two weeks into July:

The S&P has spent two weeks in a 20 point range. And the futures are expecting more of the same. Today the spread to spot VIX shrunk to .6 at one time today and sits currently at around .9. The futures are going to have to be dragged kicking and screaming higher. As the VIX eclipsed 14, they refused to move. Complacency is very high, even though there are 3 weeks until expiration of the front month:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:43:36 | 14.30 | -0.35 | 14.55 | 14.80 | 14.25 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:43:36 | 15.70 | -0.25 | 15.85 | 16.05 | 15.60 |

| VX V3-CF | S&P 500 VOLATILITY | October2013 | 16:43:36 | 16.70 | -0.20 | 16.90 | 17.00 | 16.65 |

And all this quiet ahead of a lot of data. FED meeting, jobs, GDP, ISM. There is no fear. If this is how it’s going to be, I am certainly going to take advantage of it.

FAS butterfly for August 17th:

Long $71, short 2x $74, long $77. Net debit .62. The total risk is .62 and this can return $3 if the FAS closes at $74 on Aug. 17th. Nice 5-1 risk/reward for flat markets in the strongest of sectors these days.

VXX calendar at $16, Aug 2nd/Aug 9th.

Short VXX Aug 2nd for .15, long Aug 9th for .34, net debit .19. As I explained yesterday, it is really tough to lose here. The worst case scenario is the VIX drops to 12 this week and I sell out the long end for .15 or so. The futures are tight to spot with a ton of time to go. If by some miracle there is volatility in the next week, the return would be huge.

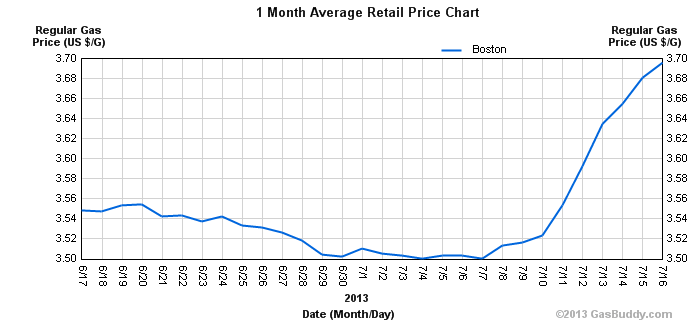

Oil got smoked today, but the worst may be yet to come. A build in inventories will do the trick, and the market hasn’t witnessed that in 5 weeks. Sold the USO puts today for 100% profit in 4 days. This trade is still incredibly crowded, as the long speculative contracts outweigh the shorts by over 11 to 1. The total spec longs is a record. Still short UCO (2x oil) puts at $34,33, 31.

Disaggregated Commitments of Traders-All Futures Combined Positions as of July 23, 2013 : Reportable Positions : :------------------------------------------------------------------------------------------------------------- : : Producer/Merchant : : : : : Processor/User : Swap Dealers : Managed Money : Other Reportables : : Long : Short : Long : Short :Spreading: Long : Short :Spreading: Long : Short :Spreading : ---------------------------------------------------------------------------------------------------------------- CRUDE OIL, LIGHT SWEET - NEW YORK MERCANTILE EXCHANGE (CONTRACTS OF 1,000 BARRELS) : CFTC Code #067651 Open Interest is 1,865,700 : : Positions LONG SHORT : : 375,919 333,517 98,616 513,433 225,699 335,934 30,090 317,115 140,127 84,905 276,572 : :