For the first time in a month, and not every month offers this particular structure, the VXX is spring-loaded to the upside and not susceptible to significant daily drops. This condition will last for about two weeks. There are a few reasons for this:

A. The VIX is nearer the lower levels of the year, and the upside is far greater than  the downside. It is far easier for the VIX to jump 20% than for it to fall 20%. The VIX is also rolling into September already, which holds its value longer due to the month’s horrible market history.

B. The VXX is holding all of the same month of VIX futures, August. Because it does not hold a significant percentage of the month farther out at higher prices, it is less buffered to VIX spikes. Also, the new September futures rolled into will hold their value due to aforementioned September history.

C. The VIX futures expiration cycle is one week longer. This will reduce the rate of decay of the front month premium.

D. The spread of August to VIX spot contracted to 1.80 today. That is only 4 cents of daily premium to spot decay for the VXX if the VIX remains at 14.6. And this is only at the outset, as it rolls into September this number could fall.

E. The negative roll is lower rolling into September than it was rolling into August. It is currently 5 cents per day.

This VXX chart should be a loud hint toward what can happen around this time in the cycle, and I just described why the odds are even more tilted in the VXX’s favor:

The futures:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX N3-CF | S&P 500 VOLATILITY | July2013 | 16:39:45 | 14.25 | 0.20 | 14.00 | 14.60 | 13.90 |

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:39:45 | 16.20 | 0.45 | 15.75 | 16.39 | 15.65 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:39:45 | 17.45 | 0.50 | 16.90 | 17.57 | 16.79 |

The VIX term structure of option prices (not futures, S&P options vol):

VIX Volatility Index values generated at:Â Â 07/16/2013 13:18:24

| Trade Date | Expiration Date | VIX | Contract Month |

| 7/16/2013 1:18:24 PM | 14.26 | 1 | |

| 7/16/2013 1:18:24 PM | 15.17 | 2 | |

| 7/16/2013 1:18:24 PM | 15.91 | 3 |

The VIX is rolling into September, so it will have a tough time falling. The two most probable scenarios for the VXX right now are higher and flat for a significant stretch. And you saw today what a meager 6 point S&P drop did to the VIX, moving it higher by 5%.

I sold the July 26th 17.5/16 VXX put spread for .60, which means no blood until 16.90 on the VXX next Friday. I will use any dip to add other put spreads preferably at 17 or 16.50. It should be clear by this strategy that I am not looking for a VXX spike. I am merely recognizing that the odds are stacked against the VXX’s frequent drops. Flat to up on the VXX makes this a winner. Asymmetric risk/reward.

Meanwhile, I also sold a July 19th IYT $115/117 call spread for $.67. Late July and early August have demonstrated challenges to the market historically, and after a 5% run in the S&P in July alone, and an 8% straight move higher since June 24th, I don’t mind setting spreads higher than current prices, forcing the market to prove it during and after earnings season.

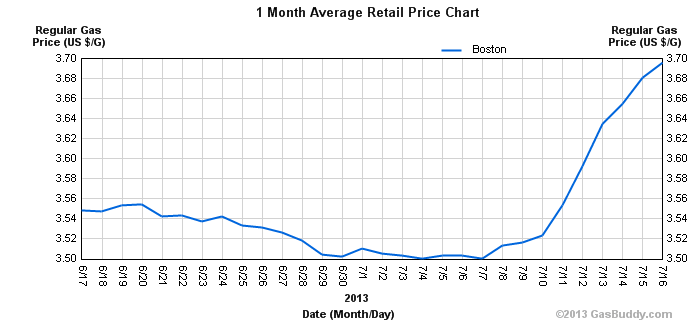

I’m still bearish on oil at the highs;Â 40 cent moves in gasoline tend to get political attention, and this one already has. This is 20 cents behind the RBOB contract due to a time lag from refiner to pump:

Senators Grill Refiners Over High Prices Amid Oil Boom

http://www.bloomberg.com/news/2013-07-16/senators-grill-refiners-over-high-prices-amid-oil-boom.html

Long UCO August $31 and $32 puts and long USO Aug $35.5 puts. May sell weeklies against the USO Aug on Thursday. Short UCO July 19th $35/37 call spreads that will roll if necessary.

Still short SPY $167-169 and $168-170 call spreads for July 19th from last week as well. Will roll out and up if necessary.